<— BACK TO MULTIFAMILY TALKS

David Sullivan: Solving Rental Evictions

Published Nov. 2018

David Sullivan, CEO of Till illustrates why tenant evictions occur and the myth of landlord “late-fee revenue.”

SHARE VIDEO:

If you enjoyed this video please feel free to share it. Our presenters, events team, and video team spent many hours preparing each talk, help us in thanking them by sharing a video with your friends and colleagues.

VIDEO TRANSCRIPT

My name's David Sullivan, I'm the CEO and Founder of Till. I'm here to talk today about why evictions suck. The underlying problem that creates eviction risk on our portfolios and how we can use innovative financial products to improve both the residents lives and ability to pay rent but also your portfolio's performance.

So each year 900,000 evictions occur. Many more occur in the shadows and we as landlords use different tax to get residents out of our portfolios who aren't paying rent. So why do evictions occur? Well the Rent Is too damn high, we've all heard that story and that's true. Affordability challenges are affecting all of us as landlords in finding residents who have the right ability to pay rent. We have serial skippers and professional residents who squat. We've all faced in battle those. But more importantly I believe that the cash flow challenges within our resident base. Drive almost all of the evictions and default we see in our portfolios and place eviction risk on an even broader set of residents.

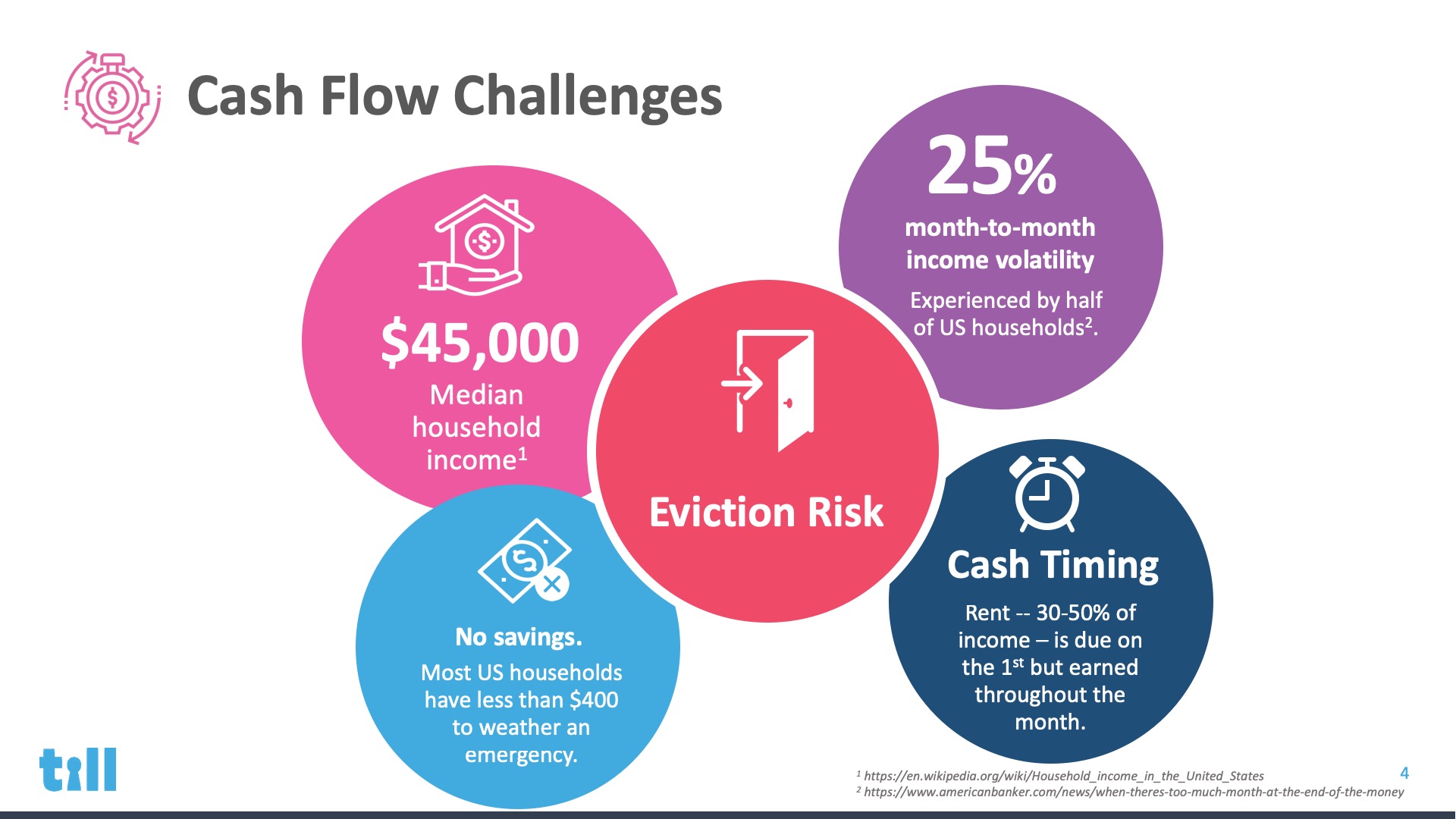

So let's go down another level. Why do our residents face eviction challenges and cash flow risk? Well we have median household income of about forty five thousand dollars and that is really representative of stats that we all know. We've had stagnant wage growth with rising costs rent being the primary cost that we replace on the resident base. In a similar demographic, half of Americans see 25 percent month to month income volatility. Our resident bases are working multiple jobs, they're paid hourly, they're part of the gig economy. This makes their ability to budget and to pay rent challenging.

Most people in the country also have limited savings. Half of the country has less than four hundred dollars in accessible savings to actually weather a financial event Then finally we as landlords are placing a constraint on the resident base ourselves. We're putting a cash timing constraint by charging rent on the first of the month which makes it hard for the resident who is having to pay 30 to 50 percent of their income to us as landlords on that day.

So okay if a resident can't pay rent, what do they do? What current options exist? We have the family bank, family and friends, asking mom and dad or cousins or relatives for help. That works but people are embarrassed to do it and the capital base is inherently limited. We have banks real banks. The reality is many of our residents, especially in the workforce housing space, are under banked. They have limited access to the right capital and credit solutions that can stabilize their financial ability and means to pay rent on time.

We have new online peer to peer banks popping up, these are offering more personalized lending solutions that can help solve this problem but many have principal requirements that are above what the resident actually needs. We have payday and title lenders. These are real. Many of our residents are using payday and title loans to finance rent payday and title loans are giving their residents two to four weeks to pay them back and charging them three to 700 percent APR’s. As a side note, there are three times as many payday lenders sitting in our rental communities as there are McDonald's in the country. So they are a very real capital source for our resident base. And what's what the worst part is about are residents using them as a credit solution is that they are increasing the long term default risk on the resident base. The average payday loan will be refinanced eight times. And once that borrower is hitting that eighth borrowing cycle they are likely in default to both the payday lender and to use the landlord.

Finally, I want to highlight the landlord us. We are landlords. We as landlords offer credit to our consumer base our residents but it is not a effective credit. We do this in two ways. We have payment plans. We have a good resident they'd been with us for a few years and they hit a cash timing problem. We give them a payment plan because we don't want to lose them and we understand the cost of the eviction.

But more prevalent is the second form of financing we're offering them. We're giving residents a form of financing called a late fee. The late fee in most jurisdictions is 5 to 10 percent of rent for that month and we usually give them two weeks to pay. So what happens if they don't pay? We then file eviction and charge them eviction fees and them if they don't pay that we put them on the street. So let's just look at the initially late fee. The initial late fee is let's say 10 percent and we give them two weeks. That is a over 200 percent APR and we are not giving the resident any adequate time to solve the problem that they're facing.

Fair housing makes custom rental payment solutions challenging. And we as landlords are under resourced to deliver this type of credit. We are not re underwriting them. We can't read underwrite them. We don't actually know what the residents credit risk is at this point of need.

So I want to dispel a myth that I hear all the time from our landlord partners and people that we work with. So I talked all the time to landlords and they say well, we like our late fee revenue. I want to challenge that. Late fee revenue is a lost center. At best, it is a breakeven value proposition. I want to quickly talk you through why I believe that and why we as landlords are really bad at delivering credit.

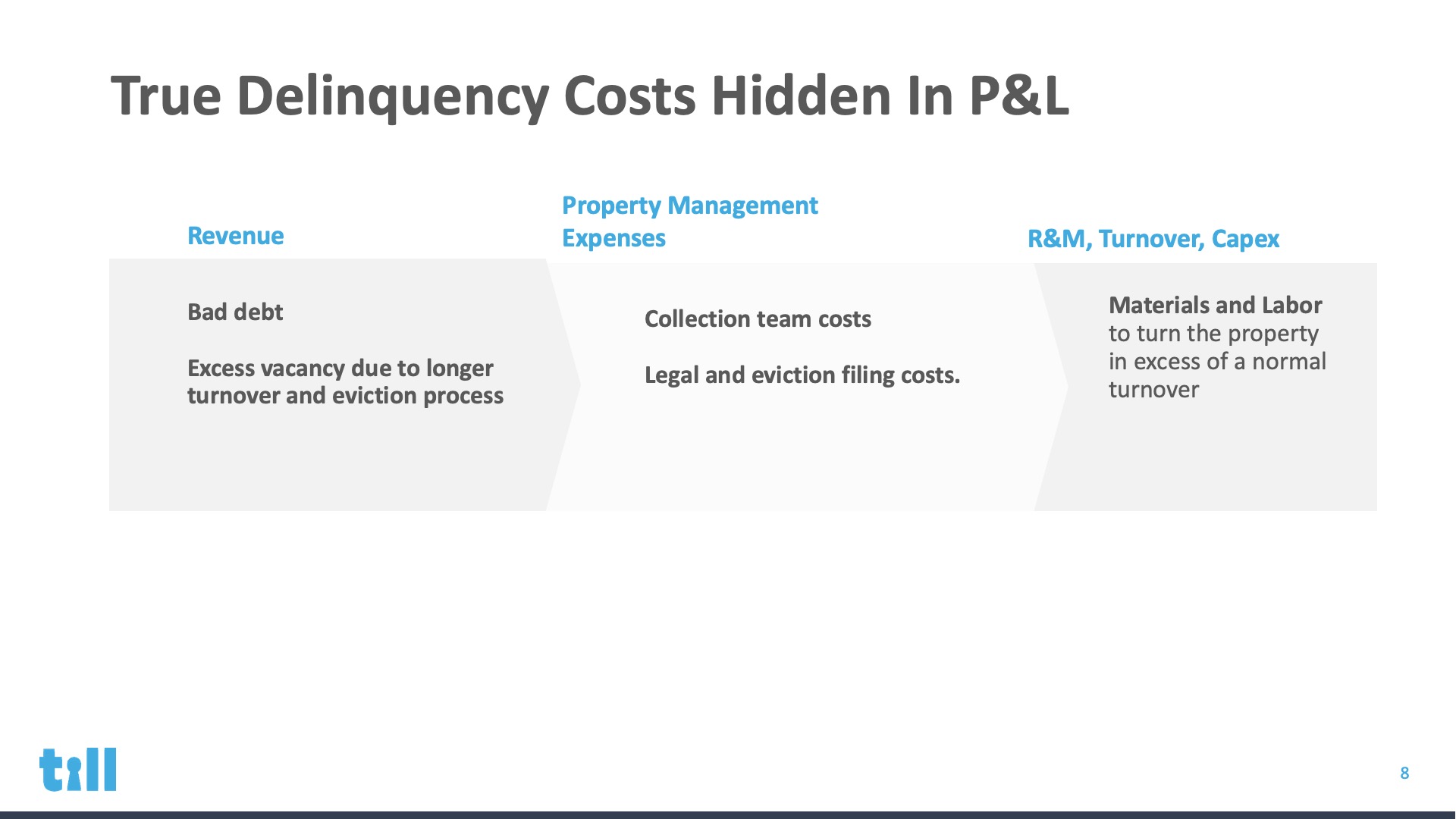

We as landlords look at our income statements and there is an explicit line that says late fee revenue that makes us feel good. I ran a portfolio that had 1 million dollars in annual leave fee revenue that made me feel good. Well some residents might not pay but we made a million dollars. That is not true. We pulled it apart and the challenge in understanding late fee revenue is understanding the costs that drive and are associated with the doing quinsy and the collection effort. I challenge you to go look at your portfolios and actually pull apart these costs to see whether you're making money. And I would hands down bet that you are not. The challenge is we have five different items sitting in three different sections of our income statement. They create a loss center. We have bad debt that's easily tracked it sits in revenue. We have excess vacancy due to longer turnover for an eviction than a regular turnover. That also sits in revenue but it's harder to understand. We have our collection teams costs we have an eviction filing cost hidden in property management expenses. We then have materials and labor to turn a turn over. We all know our evictions cost us more. We have materials and labor to turn on eviction. Turnover beyond a normal turnover that are hidden somewhere. Ideally we shove them into Cap X but are also hidden in turnover and maintenance costs. The portfolio I was running I did this exercise a million dollars in annual revenue off late fees. We were spending one point four million dollars on those items we were losing 400,000 dollars a year charging our residents over 200 percent APR is giving them two weeks to pay us back and still evicting many of them.

The worst part is the resident is the biggest loser in this equation.

So even if they aren't evicted they face the stress of eviction month to month. But the ones that are evicted we are damaging their confidence, we are destroying their credit scores and we're destroying their ability to find housing in the future. Many families who are evicted are forced into transitional housing with family or friends homeless shelters or hotels, children are ripped out of schools and there's just an overall loss of community. Parents who are the breadwinners of these families who face the cash instability or the cash uncertainty, are then distanced from their job opportunities making it harder for them to actually earn income to rent a home from us again.

I want to talk about two solutions. We have a suite of financial products that we're delivering into and specifically designed for the multifamily and single family rental housing industries. We have a core rental loan that is meant to weather a financial emergency. It is a three to six month loan. We underwrite the resident on their ability to pay. We want to make sure that they have the ability to pay us back and the ability to pay you as a landlord in the future. We partner with landlords to deliver this product is a B2B to see model. This is another tool that the onsite property managers have to offer their residents who are struggling to pay rent. We underwrite them. We take the entire default risk away from the landlord and we pay you the landlord directly on time and in full. Every resident's balance that borrows from us goes to zero when we pay you. We also have a short term rental loan that is meant to solve intra month cash timing issues. So as I said earlier 30 to 50 percent. of our residents income is spent on rent.

We have designed as landlords a very inflexible system allowing our residents to pay rent when they have a challenge and we use sticks with late fees to hurt them to get them to pay on time. The short term loan allows us to pay you as landlords every single month on time and it gives the resident ultimate flexibility over that month's time period to pay us back. They can pay us back on their pay cycles, they can pay us back weekly, they can pay us back daily whatever improves their ability to pay you rent to lower their ultimate default risk and costs you as a landlord.

So I am very passionate about addressing the affordability challenge with innovative financial solutions. I believe that alternative credit specifically designed for the rental industry can do good and do well, that we can improve the financial stability of your resident base while improving your portfolio's performance. Thank you.