When considering your largest real estate expense, most people think of utility charges, insurance costs, H.R. fees paying for your employees administration and a slew of others. But would it surprise you if in fact property tax is your largest expense? In 2017 in the US alone over five hundred and thirty billion dollars was paid in property tax and upwards of 300 billion was paid by owners and multi-property portfolios businesses organizations.

VIEW PRESENTATION:

VIDEO TRANSCRIPT:

Hi Everyone.

My name is Mordecai Katzman and I'm the President and Co-Founder of a company called Rethink Solutions. Today I'm gonna talk to you about your largest or at least one of your largest real estate expenses that really any typical occupier owner and manager of a multi property portfolio is going to encounter.

When we talk about real estate expenses what comes to mind?

I think typically most people think of utility charges. Insurance costs you know H.R. fees paying for your employees administration and a slew of others. But would it surprise you if I told you that in fact property tax is your largest expense? In 2017 in the US alone over five hundred and thirty billion dollars was paid in property tax and three hundred billion dollars out of that or upwards of 300 billion was paid by owners and multi property portfolios businesses organizations

What I still find interesting is when I'm speaking to multi property owners and I ask them what they pay in property taxes, I'll still get answers that are really in the form of ranges oh anywhere from two hundred to five hundred million dollars. at least for me three hundred million dollars is still quite a significant range for one of your largest expenses. I think that's because it's tax and people look at tax a little bit differently. Frankly as soon as I mentioned property tax people's eyes typically glaze over and I think it's because no one has patients for tax or even property tax.

They see it as a tax that simply needs to be paid and I'm here today to tell you that property tax is really unlike the other taxes. I think it would be fair if you're talking about income taxes or corporate taxes or even sales and use tax that are very fact based. You're providing the individual taxing jurisdictions information about your sales your profits your income and as a result they're taxing you. But for property taxes individual jurisdictions are telling you what the value of your property is and hence based on your value this is the tax you're going to pay.

Property tax is different, as I mentioned it's really very subjective because you're getting values from the individual jurisdictions and I should point out that there's over 17,000 different taxing jurisdictions in the US, so when you talk about transparency and standardization it's all over the place. All the more reason that this needs to be managed and can be controlled because there is tremendous opportunities for savings. Just to stress on that point for a moment there was a study done by an international organization that measured all the various jurisdictions both in the U.S. and globally that found the average U.S. jurisdiction just got a grade from a C to a D when it came to transparency and standardization. Again tremendous tremendous opportunities here.

I was recently talking to one of our clients the senior property tax manager for this particular portfolio and he had told me that the CFO now recognizes that they exist and that it's a good thing and a bad thing. I proceeded to ask, OK so where's this going. What's good what's bad. So firstly it's a good thing because he says now that you're such a significant line item on our balance sheet and income statements we need to be paying more attention. So whatever tools resources you need to mitigate and control this expense and cost, we're all for it whatever you need you let us know so that frankly sounds pretty good.

So what's the bad thing. Well he said, Now the CFO knows that we exist, which means there's tremendous pressure on this department to do something about controlling this vast and wide expense property taxes are also rising and our research has shown that even when values are staying constant, meaning your values aren't going up, the taxes are still going up because those local jurisdictions, their fees aren't going down and they need to pay for their local improvements.

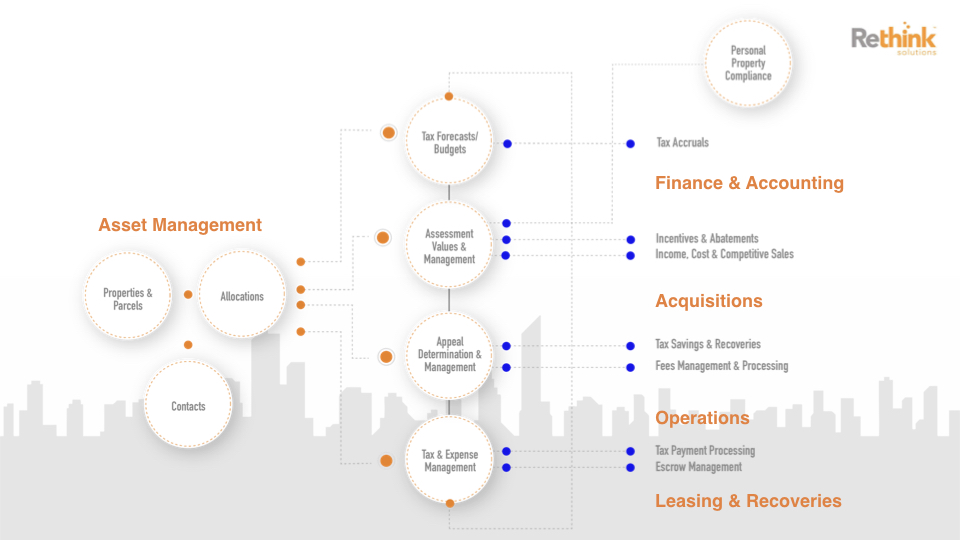

Another interesting thing about property tax is that it's going to impact your organization in a number of different ways across all sorts of different departments. It would be very typical or traditional to find one or two people within a property tax department sitting somewhere in the office again which department they belong to is usually questionable as well but sitting there doing their thing managing their values managing their taxes and submitting some information to accounting but as you can see the entire property tax management process is very complex and it really touches on all sorts of different departments.

So yes once you verified your payments you'll send it off to accounting but you've got your finance department doing their forecasts and budgets and isolation in a silo using their own data their own spreadsheets to determine what they think property tax is going to look like. You'll have acquisitions going about acquiring more properties for your portfolio. Sometimes doing their own work up or not even inquiring with property tax as to what the tax impact is going to be. And what I'm happy to see that that more recently this is now becoming a requirement. Certain companies aren't letting their acquisitions team acquire without having sort of a suggestion or a report from property tax.

And the list goes on. It affects operations it affects your leasing in terms of setting your rents or even recovering tax from those individual portfolios. So again it affects the entire department. And today it's all done in silos. Each with their own.

That sets of data without one talking to one another so that's so we're where we come so far. So we've noticed that the property tax itself is going to be one of your largest expenses. We know that there are significant opportunities for savings there. And we know that up until now it's been fairly mismanaged as we've seen it's all done in silos all over the place. And there's a lot of data involved in the process itself. In fact from a data perspective because again you're getting data from so many individual jurisdictions. It's not uncommon for an individual property to have at least one hundred pieces of individual data on an annual basis.

Again extrapolate this to a portfolio of two three hundred properties you're easily dealing with 30000 pieces of data every year. So that's a concern.

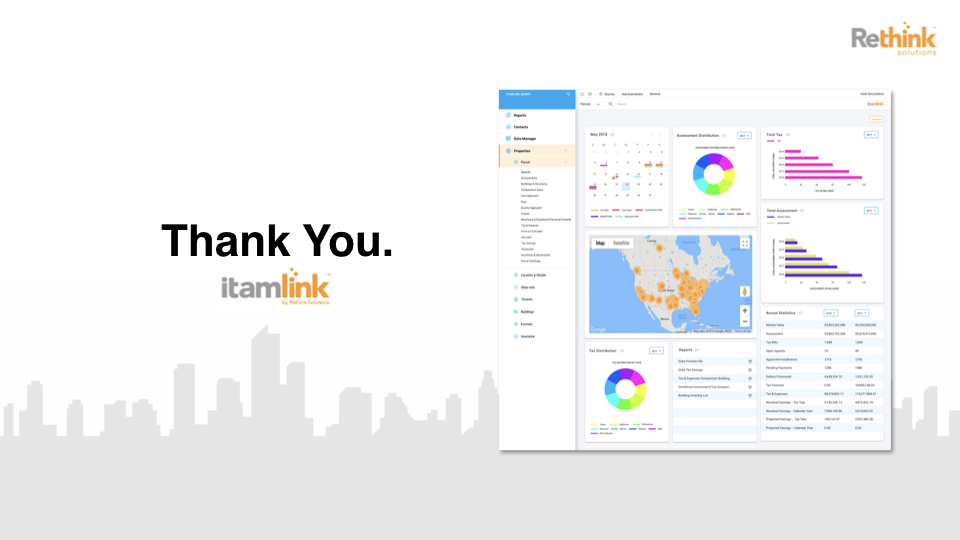

So what do we do?

Well we have to rethink the way we manage your property taxes and that's frankly where we come in our solution lets you manage and optimize the entire process and bring everyone together on a common platform and what that's going to achieve and that's going to allow you to empower your users to make smarter better decisions when it comes to every aspect of your operation that that addresses or includes property tax and these aren't just buzzwords anymore. It's very important. Again all these technologies exist today and they fit quite naturally and very well within property tax the ability to collaborate with those other departments the ability to automate some of your workflow. So as soon as you get a new value forecast and Budget has that so they know exactly they can alter and adjust in real time you can integrate with other systems you can apply a eye to help you determine where the values are out of sync maybe certain values certain properties. This is what we should be looking at to appeal to further drive savings.

At the end of the day I think we're all trying to achieve the same goal. The goal is to maximize portfolio value. And what I'm here to tell you today is that rather than you know addressing the revenue side which a lot of systems and usually some of the easy pickings to be able to you know acquire better properties to make sure they're fully rented out to drive and maximize the revenue from individual locations. That's obviously a way to drive value and revenues. But another way to do it is also by looking at your expense side and being able to control the costs especially something as large as the property tax is going to have a significant impact on the bottom line value so quite a bit so far.

So just as a quick recap if there's one message I can leave you with is that don't ignore your property tax. As I said there's tremendous savings opportunities there. If they control all tax again you just need the right tools information and data available so that you can properly address it make well-informed decisions that will impact not just the tax side but all the other departments within your organization. Thank you very much.